We have new bank ratings this week!

This week's post discusses two other topics as well:

-

De novo banks, or lack thereof, this year; and

-

Increases in delinquent loans.

We also commend banks that are keeping their loans in pristine condition. To that end, we have a list of 52 5-Star banks that have been rated 5-Stars for three years or longer and have no short or long term delinquencies on their books.

All New Bank Star-Ratings and Data This Week

All bank star-ratings have now been updated on bauerfinancial.com and on our rate pages; credit union ratings and data will be available in the next couple of weeks.

Back in March (JRN 42:11) we wondered if 2025 would be the year for a de novo bank comeback. As we approach the ninth month of the year, the answer is becoming crystal clear. And the answer is, “No”.

To date, there have only been three de novo banks and one wasn’t really a de novo. By that, we are referring to 4-Star Thrivent Bank, Salt Lake City, UT (59286), which converted from a credit union on June 1st. As an Industrial bank, the terms for Thrivent Bank’s conversion were quite stringent, much more so than for a community bank.

Thrivent Bank was required to have a minimum of $280 million of paid-in capital; a leverage capital ratio of at least 12% and a minimum total capital ratio of 15%. It exceeds all measures handily.

For comparison, the paid-in capital required for the five most recent community bank de novos ranged from $27 to $50 million and the Tier1 Leverage Capital Ratio minimum requirement for each was 8%. That’s quite a difference.

3½-Star Five Rivers Bank, Paramus, NJ (59345), a community bank, was the only true de novo to open in the second quarter. Five Rivers was required to raise $33.5 million in initial capital and maintain a Leverage ratio of at least 8%.

The only other de novo this year was 3½-Star BankMiami, Coral Gables, FL (59354) which opened in March. Instead of being a comeback year for de novos, 2025 is shaping up as one of the slowest. During each calendar year 2023 and 2024, six de novo banks opened and in 2022 there were 15. That was considered low at the time. Not anymore.

While we are still pouring over the new bank data to determine what is newsworthy for our readers, we do have this other piece of good news to share:

Two hundred and seventeen U.S. banks ended the second quarter with

- NO repossessed real estate,

- NO loans that were delinquent 90 days or longer; and

- NO short-term delinquent loans on their books.

We commend them all. Of the 217, 191 (88%) are community banks and 170 (78%) are rated 5-Stars. We wish we could fit them all on page 5 since they all deserve our accolades, but no dice. We had to narrow it down.

To get our count down, we selected all 5-Star banks where loans account for at least 60% of total assets and that have been rated 5-Stars by Bauer for at least three years (12 consecutive quarters or longer). This left us with the 52 banks you will find on page 5 of this week's issue of Jumbo Rate News.

The decrease in the number of 5-Star listees on our rate pages is evident as they all fit on one page now. Three listees moved from the 5-Star category to the 4-Star category whereas none went the other direction.

4-Star Capital One N.A., McLean, VA (4297) has temporarily (we hope) lost its fifth star due to its acquisition of Discover Bank in May. When we last reported on this transaction (JRN 42:21), we were using first quarter numbers. We knew it was going to be a behemoth, but the combined bank is even bigger than we expected.

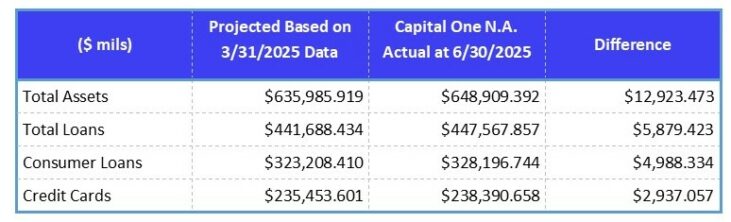

Here’s what we projected the combined bank would look like… and what has come to pass:

As it stands, only five U.S. banks have more assets than Capital One N.A.; only four have a larger loan portfolio; and none have higher consumer loans or credit cards loans outstanding as of June 30, 2025.

Any acquisition is going to cause some growing pains which can often lead to a lower star-rating. When the combination creates a bank the size and complexity of this one, that likelihood is even greater. It is still quite strong. Remember, Bauer recommends all 5- and 4-Star rated institutions.

The other two listees that went from 5-Stars to 4-Stars this week were: 4-Star First Utah Bank, Salt Lake City, NV (22738) and 4-Star New Omni Bank, N.A., Alhambra, CA (23086).

First Utah Bank is one of just 14 community banks headquartered in the Beehive State. It currently boasts $863.277 million in assets and $79.161 million in net worth. Its leverage capital ratio (CR) is 9.12% and its total risk-based CR is 12.0%. However, like many banks, First Utah is seeing its delinquent loans rise. That made the difference in its star-rating.

New Omni bank is in a similar situation. Its capital ratios are well above the regulatory requirements and it is well positioned to weather any storm. A sharp increase in both delinquent and short-term past-due loans caused it to lose its fifth star this quarter.

As we see even these very strong listees begin to struggle with loan quality, the banks listed on page 5 become even more noteworthy.