The dreaded "R" word - Recession - has been making its way into more conversations lately. We are not prepared to say that a recession is imminent, or is even coming, but we like to be ready for any circumstance to come our way.

History has taught us that banks make fewer commercial loans when the country is in a recession. Commercial loans are often hit hard during a recession. Therefore, this week we look at 51 banks that could potentially be affected in the event we do find ourselves in a recession.

Commercial loans are already underperforming most other loans. This is particularly true with the banks we highlight in this week's issue.

Commercial Loans and the “R” Word

On May 7th, Federal Reserve Chairman Jay Powell indicated that, while risks have risen for both unemployment and inflation, at 4.2% and 2.3%, respectively, they are both still moving toward their respective targets. The U.S. economy has proven to be very resilient thus far, so “the right thing to do is wait for clarity” on the direction of the economy. The fed funds rate, therefore, was left unchanged again.

Economic uncertainty seems to be on everyone’s mind and the “R” word, “Recession”, has been finding its way into more conversations. In fact, The Conference Board, a global think tank for over a century, reported on April 29, 2025, that U.S. consumer confidence has dropped for five consecutive months. In April alone, it “plunged” 7.9 points.

According to that same source: “Consumers’ short-term outlook for income, business, and labor market condition’s—dropped 12.5 points to 54.4, the lowest level since October 2011 and well below the threshold of 80 that usually signals a recession ahead.”

These findings were reinforced with those of the latest Beige Book, (released on April 23rd), which noted that the outlook in several U.S. districts “worsened considerably as economic uncertainty, particularly surrounding tariffs, rose”. Consensus opinions can be wrong, but if they’re right, what does that mean for commercial loans in the coming quarters?

History has taught us that banks make fewer business loans when there are concerns of an oncoming recession. How much of that is by choice and how much is simply lessened demand, we don’t know. But we do know, the growth in troubled commercial loans during calendar 2024 was undeniable.

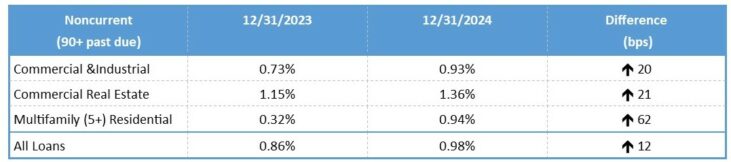

When we refer to commercial loans, we are talking about Commercial & Industrial loans (C&I), Commercial Real Estate (CRE) and Multifamily (5 or more) Residential Real Estate. The percentage of total noncurrent loans (those 90 days or more past due) increased 12 basis points (bps) - from 0.86% to 0.98% - between the end of 2023 and the close of 2024.

Commercial loans did much worse:

When we reported on CRE last quarter (JRN 42:07), we noted that the Heartland was being hit particularly hard. That is still the case for Noncurrent CRE (2.15% in the Kansas City region). However, the New York region reported the highest multifamily residential and C&I delinquencies at the close of 2024 (1.70% & 1.22%, respectively). New York also had the second highest CRE at 1.66%, followed closely by Atlanta’s 1.64%.

We can see all three of those regions well represented on page 5, which contains a list of 51 banks with commercial loans to watch. To compile this list, we took all banks rated less than 4-Stars where commercial loans account for at least 44.5% of total loans. We then removed any that reported delinquent commercial loans of less than (or equal to) 2.9% of total commercial loans. Let’s take a look at a few of them:

2-Star Community Bank & Trust—West Georgia, LaGrange, GA (25796) is no stranger to this list. Its delinquent loans have persistently been well above its peers. Considering that commercial loans comprise over half of its portfolio, we know there are bad apples in this bunch. Delinquent commercial loans represented 7.64% of total commercial loans at 9/30/2024; by year-end, that was up to 10.89%. The biggest culprit: CRE, with 17.69% reported as nonperforming.

3-Star VisionBank, St. Louis Park, MN (58063) is a new addition. At the end of the third quarter of 2024, VisionBank reported that nonperforming loans represented 2.6% of its total loans. Not great, but by year-end, delinquent loans had doubled, bringing that ratio up to 5.3%. CRE comprises half of its loan portfolio, so one would think that (CRE) is the biggest problem area as well. It is not.

The ratio of nonperforming CRE loans is 2.96%; C&I nonperformers are 4.27%, and nonperforming multifamily residential are 7.58% of the total. (To be clear, multifamily loans represent less than 7% of total loans; C&I loans account for just under 12%.)

Nonperforming commercial loans at 3½-Star United Republic Bank, Omaha, NE (58359) jumped from 2.61% to 7.26% during the fourth quarter 2024. Looking at its fourth quarter Call Report reveals only two categories with nonperforming loans. They are CRE (with $5.799 million in nonaccrual status) and C&I (with $1.126 million in nonaccrual status). That makes its overall nonperforming loan to total loan ratio 4.34%.

Fortunately, a sneak peek at United Republic Bank’s first quarter 2025 Call report revealed those numbers have improved greatly.

During the first quarter 2025: nonperforming CRE loans dropped from 8.94% down to just 1.23%; C&I went from 5.24% down to 3.71%; all Commercial Loans dropped from 7.26% to 1.62%; and Total Loans fell from 4.34% all the way down to 0.96%. That deserves an attaboy!

We are currently combing through March 31, 2025 bank data and fully expect to have new bank star-ratings available before June 1st.