All credit union star-ratings are now updated with September 30, 2025 financial data.

Over the past five years, credit union industry assets have grown by more than 1/3rd. As the large get larger, the top 10% by asset size control nearly 80% of all industry assets.

Credit unions of all sizes are reporting uninsured shares/deposits. This week's Jumbo Rate News has a list of underperforming credit unions (either rated 2-Stars or below and/or less than "Adequately Capitalized") with uninsured deposits.

Credit Union Star-Ratings Now Updated with Q3 Data

We promised new credit union star-ratings would be out soon, and they are. According to this new (September 30, 2025) financial data, total industry assets increased 3.7% ($86 billion) over the year ending the third quarter at $2.40 trillion.

On an island by itself, that seems like reasonable growth. Now consider this. In the past 5 years (since Q3’2020) credit union industry assets have increased by more than a third (34.1%)

For comparison purposes, bank industry assets also grew 3.7% during the 12 months that ended Sept. 30th; banks grew 18.3% since the third quarter 2020. That’s about half of the growth rate of the credit union industry.

All credit unions cannot say the same, however. In fact, only the 459 credit unions with assets exceeding $1 billion can say that (as a group). All asset size categories less than $1 billion lost between 0.3% and 6.9% of their total assets in the 12 months leading up to 9/30/2025.

Membership is trending in a similar, although steeper, slope. One category, the 575 credit unions with between $50 million to $100 million in assets, saw membership drop by 10% in the last 12 months.

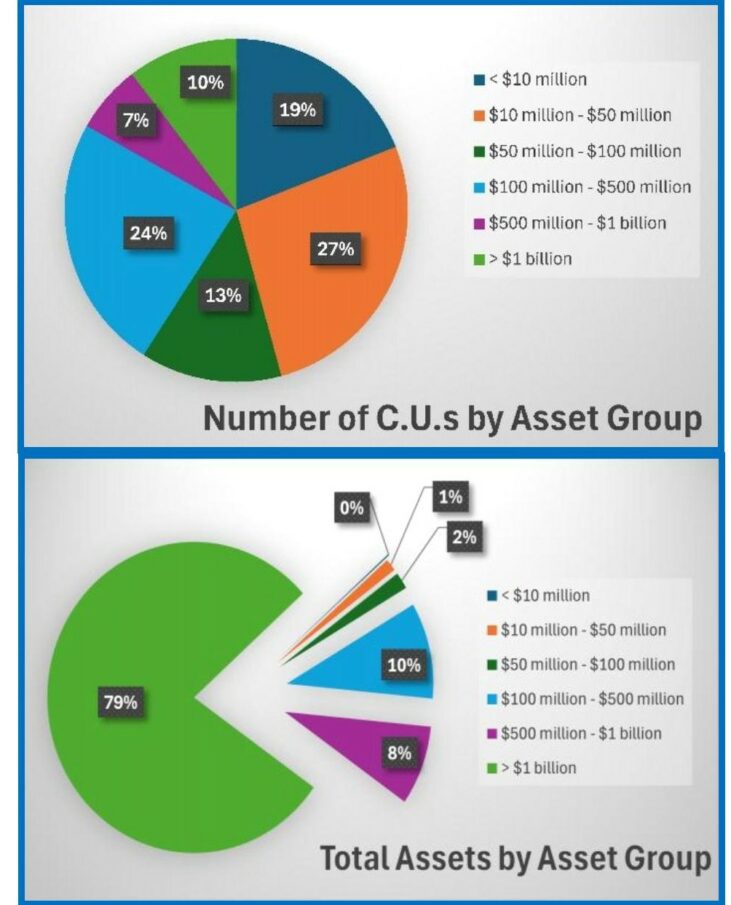

What we see in the diagrams below is that: a) the number of credit unions in each asset size category has not changed appreciably, the smallest account for 19% of the industry and the largest account for 10%, but b) the assets, particularly of the smallest three groupings have dwindled to less than 4% of the entire industry. The largest 10% of CU’s control 79% of industry assets.

With assets exceeding $194 billion, the largest credit union, 5-Star Navy Federal CU, Vienna, VA (5536), controls over 8% of total industry assets all by itself. The next largest credit union, 4-Star State Employees’ CU. Raleigh, NC (66310), is less than one-third the size of Navy FCU.

Combined, these two credit unions not only control over 10% of industry assets, they are also home to more than 10% of the nearly $200 billion in uninsured shares/deposits reported by the entire industry. It’s a good thing they are financially strong.

The credit unions on page 5 cannot necessarily say the same. The 47 credit unions on page 5 are either rated 2-Stars or below and/or are less than “Adequately Capitalized” by regulatory standards. They each reported some amount of uninsured shares/deposits at September 30, 2025.

These credit unions range from just over $2 million in assets all the way to $4.154 billion in assets. Similarly, the amount of uninsured shares/deposits ranges from just $17,000 to more than $350 million. That $350 million is at 2-Star Connexus Credit Union, Wausau, WI (66538). With over $4 billion in total assets and more than 450,000 members, Connexus is the 6th largest CU in Wisconsin.

With a capital ratio of 7.97%, Connexus is considered “Well-Capitalized” by regulatory standards. However, for the past couple of years, it has been struggling with both loan quality and profitability. There are signs that it may be making a turn for the better, but we live in hurricane country. We know we can’t count on that turn until it has actually taken place. So we wait, and hope for the best.

Three others have uninsured shares exceeding $100 million. They are:

2-Star Civic Federal CU, Raleigh, NC (24003), a $3.5 billion asset credit union with $2.8 billion in shares/deposits of which, $270 million is uninsured.

Zero-Star Greater Nevada CU, Carson City, NV (68228) boasts assets of $1.687 billion and shares/deposits of $1.589 billion. At the end of the third quarter, $127 million of that was reported as uninsured.

And, 2-Star True Sky FCU, Oklahoma City, OK (24934), which has assets of $819 million and total shares/deposits of $757 million. True Sky reports its uninsured amount is just shy of $125 million.

Both Greater Nevada and True Sky are also classified as undercapitalized by regulators.