All 2024/25 completed transactions, as well as those that have been announced, can be found inside this issue. The average asset size of the “announced” (not yet completed) is $469 million.

As the assets moving from the bank industry to the credit union industry have been mounting, so has the opposition to these transactions.

Size is not the only concern, as you will soon see.

Credit Unions Acquiring Banks

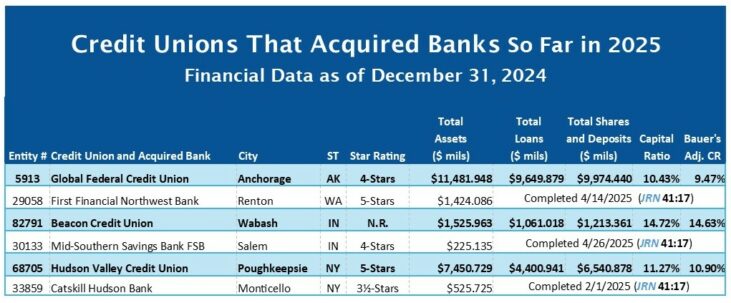

In the past 16 months, (January 1, 2024—April 30, 2025) no fewer than 32 credit unions acquired, or announced plans to acquire, 35 community banks. (There may be others that we don’t know about yet.) We have reported on this several times already. Once a rarity, these combinations multiplied through 2024. Only three have been completed so far this year. They are:

(For the complete list of 2024 credit union and bank combination activity, order Jumbo Rate News (below).

As the assets moving from one industry to the other have been mounting, so has the opposition to these transactions. In fact, at least one such merger was aborted, reportedly because of that opposition. While these transactions accounted for less than 15% of all bank acquisitions in 2024, there are some big implications.

The first is size. With $11.482 billion in assets, 4-Star Global FCU, Anchorage, AK (5913), is already the 19th largest federally insured credit union in the country. Last month, it officially gained another $1.4 billion with its cross-state acquisition of 5-Star First Financial NW Bank, Renton, WA (29058).

Prior to this transaction, “The Evergreen State” had already lost all but 36 of its in-state banks. (There are 76 credit unions headquartered there.) On page 5 you’ll notice that three other Washington State Banks are in the process of selling to credit unions after two others sold last year. The two from last year were smaller; they didn’t raise the same red flags. These transactions are getting bigger. In fact, the average asset size of the “announced” (not yet completed) mergers inside this issue is $469 million.

Another state to watch is Arizona. Already down to 14 banks at the end of 2024, if it loses the three banks to credit unions that were announced last year, the “Grand Canyon State” will be down to just 11 banks (and 34 Credit Unions).

Bauer rates both banks and credit unions, and our concern differs from that of regulators, lawmakers and industry lobbyists. Quite simply, we want depositors to have their choice of federally-insured, credit-worthy depositories in which to place their deposits. That’s why we rate all FDIC-insured banks and NCUA-insured credit unions and no others.

On April 26, 2025, a non-federally-insured credit union, N.R. Beacon Credit Union, Wabash, IN (82791) acquired the three branch offices and $225 million in assets of FDIC-insured 4-Star Mid-Southern Savings Bank, FSB, Salem, IN (30133). That doesn’t sit well.

While Beacon C.U. carries private insurance with American Share Insurance (americanshare.com), it is not the same. Our concern is simple. Did all of Mid-Southern SB’s depositors understand that their deposits will no longer be “backed by the full faith and credit of the United States government” when agreeing to this transaction? That’s a big deal if they did not.