The Federal Reserve left the Fed Funds interest rate unchanged again at its meeting last week, but we know it is just a matter of time before that changes.

The most important thing (for us anyway) is how banks will manage their net interest margins (NIMs) when rates do begin to drop.

We are happy to report that many banks are being proactive and already preparing for that eventuality.

Interest Margins to Brag About

The Federal Reserve left the Fed Funds interest rate unchanged again at its meeting last week, which makes sense. Until we have a clear picture of what new tariffs will do to inflation, it’s best to wait. The next meeting (July 30th) should be more telling.

Until then, we have the projections from this meeting. Eight members of the Fed’s Open Market Committee (FOMC) believe (at least for now) that we will see two quarter point cuts before year-end. Seven think we will see none. The other four are split evenly with two thinking there will be one quarter point cut and two believing there will be three cuts.

When we get into next year, the range is even broader with almost a full two-point spread (from 2.50% to 4.25%). Only one participant believes the rate will still be over 4%. The majority put the Fed Funds rate in the 3% to 4% range in 2026.

For us, the most important thing is how banks (and credit unions) will manage their net interest margins (NIMs) when rates do begin to drop.

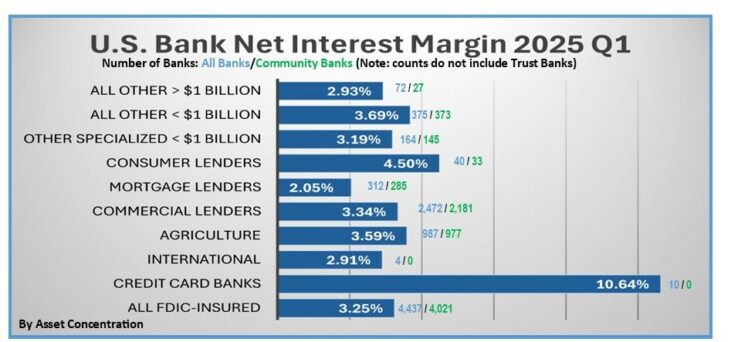

Last quarter, when we reported on net interest margins at our nation’s banks, we limited our commentary to community banks (JRN 42:13). Today, we are looking at all banks. The average net interest margin for all U.S. banks at March 31, 2025 was 3.25%; The 51 banks on page 5 each reported a Net Interest Margin of more than twice that (greater than 6.5%) at March 31, 2025.

One thing that struck us is the number of banks that specialize in Agriculture on this list. There are seven ag banks; almost as many as credit card banks.

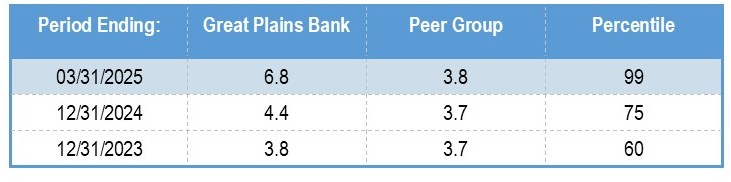

One of them, 5-Star Great Plains Bank, Eureka, SD (505), did not appear on this last quarter. We wanted to see what this bank was doing differently to boost it from the 60th percentile in its peer group at year-end 2023 all the way up to the 99th percentile today. The answer is actually quite simple. It is preparing.

Most banks have begun preparation for the eventuality of lower interest rates on loans, but few are doing so with as much gusto as Great Plains Bank.

As we already mentioned, the average net interest margin for the banking industry at March 31, 2025 was 3.25%. For community banks, that margin was 3.46%, 21 basis points higher. Credit card banks have the highest NIM, by far, at 10.64%. (None of the 10 credit card banks are community banks.) The next highest group NIM was 4.50%, earned by consumer lenders. Of the 40 banks with consumer lending specialties, 33 are community banks.

The next highest average NIM belongs to “all other less than $1 billion in assets”. This group of 375 reported an average NIM of 3.69%. All except two of the 375 banks in this group are community banks. The four International Banks, (none of which are community banks) reported the lowest NIM at just 2.91%.

In the next chart, we see community banks edge out all banks in every region except San Francisco, which happens to include Utah. Almost one-third (13 out of 41) of Utah’s banks are represented on page 5 as having NIMs more than double the national average. Utah leaves all other states in the dust. Between the Utah banks and 4-Star Credit One Bank, N.A., Las Vegas, NV, the San Francisco Region is pretty skewed.

The New York Region only has a 4 basis point difference between community banks and all banks. Its average NIM is well below the national average. In fact, the only northeast banks listed on page 5 are headquartered in Delaware. (Discover Bank will disappear from this list once Capital One files a combined Call Report. Interestingly, Capital One is not currently considered a credit card bank.)