This week's issue is divided into two topics. We first discuss the change in the target Fed Funds rate and the projections for upcoming changes.

That led us into what banks may resort to if they do not make enough money on their net interest margins - charge more fees.

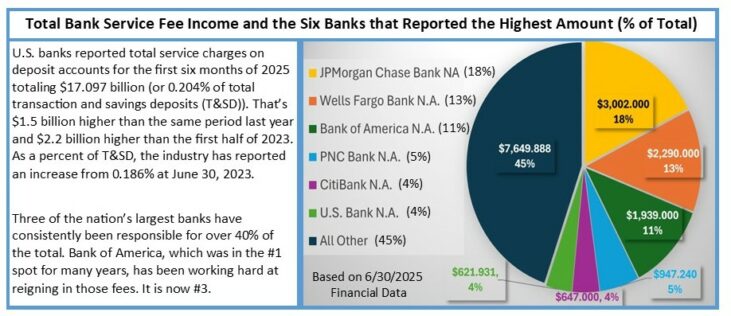

Six of the largest U.S. banks charge over 50% of all bank industry service fees. If you want to know which ones, or if you want to know which banks charge the most in relation to their deposit size, continue reading.

Interest Rates Have Begun Their Descent

The wait is over; the Federal Reserve lowered its target for the Fed Funds Rate by a quarter of a point at the end of its Open Market Committee Meeting on Sept. 17th. This marks the first rate drop of 2025, but most likely not the last.

The sole dissenter to the quarter point cut was Stephen I. Miran, whom President Trump just nominated on September 2nd. His whirlwind addition as a board member included a rush Senate confirmation on September 15th and swearing in on the 16th, just in time to vote at this meeting. Mr. Miran (and Trump) would have preferred a half point cut over the quarter point.

Miran’s term as a member of the board will end on January 31, 2026. The three-and-a-half-month term is a stopgap measure by the current administration, which has made very clear it would like to see interest rates lowered, and quickly.

The Fed Funds Rate, as we expected, was lowered one-quarter point. It is interesting to look at the projections from the committee members for the coming years. The President will likely get his wish of (much) lower rates, just not as fast as he’d prefer.

At this meeting, seven “participants” indicated they believe the Fed Funds Rate will still top 4% at the end of this year; one (probably Miran) believes it will be under 3%. The remaining 11 put it between 3.5% and 4%. The median projection was 3.6%, down from 3.9% in June.

The central tendency, which throws away the highest three and the lowest three outliers, puts the Fed Funds rate between 3.6% and 4.1% by the end of the year. That is also down from the June projections of between 3.9% and 4.4%.

These projections are just that and, as such, are subject to change with incoming data on real GDP, unemployment and inflation. However, it looks likely (to us) that we will see two more rate cuts this year: one at each meeting (October 29th and December 12th).

As savers, readers of JRN don’t typically like to see the Fed Funds rate go down. Borrowers love it. Many (if not most) of us are both savers and borrowers, so are banks. Unlike us, banks don’t have another job. All other things aside, interest income should be greater than interest expense. The larger this net interest margin (NIM) is, the better the bank will typically perform.

If the NIM becomes too small, the bank will have to find other avenues of income, like fees, for example. As an industry, U.S. banks charged service fee income equal to 0.204% (annualized) of their total transaction and savings deposits (T&SD), based on June 30, 2025 financial data. However, 51 banks reported service charge income of greater than 1.0% of these T&SDs. In some cases, much greater. These 51 banks are listed on page 5 in descending order of their respective annualized Fee to T&SD ratios.

Over Half of All Bank Service Fees Charged by Six Big Banks

At over 25% (annualized) of its T&SDs, 2-Star Varo Bank N.A., Draper, UT’s (59190) fee income stands out. We thought it was high two years ago (JRN 40:42) when it had the third highest fee to deposit ratio (then 7%). Since then, Varo Bank has seen its deposits plunge over 60%. The last year has been particularly trying. As a new bank (est. 2020) Varo Bank should be growing on all fronts.

However, in the 12 months ended 6/30/2025, Varo Bank’s assets dropped 41.3% (oddly, its loans grew 25.8%); its equity fell 22.4%; and its total deposits decreased 52.5%. These changes to its balance sheet resulted in the exorbitant Fee to T&SD ratio it has today.

Two years ago (JRN 40:28) we also reported that 4-Star Bank of America N.A., Charlotte, NC (3510) had been hit with two particularly harsh enforcement actions, one from the Office of the Comptroller of the Currency (OCC) and the other from the Consumer Financial Protection Bureau. Combined, the actions reportedly cost the bank $250 million, and it all came down to its overdraft practices. It was forced to change, so it did.

At June 30, 2025, Bank of America reported service fee income of $1.939 billion (down from a peak of $2.456 three years earlier). That brought its Fee to T&SD ratio to 0.203%, right in line with the rest of the industry.