A Wall Street Journal (WSJ) article (June 14, 2025) reported that there were almost half a million more sellers than buyers in April.

That is just one of many recent reports that caused us to pose this question.

As we exam the details, we do have to concede, the signs are there. Fortunately, our banks are much better prepared today than they were in 2008.

Is Another Housing Bubble Heading Our Way?

We have a lot to unpack this week:

FDIC’s Quarterly Banking Profiles: residential mortgage loan volumes outstanding at our nation’s banks have grown incredibly fast (nearly 18%) in the last five years (from $2.2 trillion at March 31, 2020 to $2.6 trillion at March 31, 2025).

The Office of the Comptroller of the Currency (OCC) reports that 97.6% of the first lien mortgages held by the banks it supervises were current at March 31, 2025. (That’s 2 basis points higher than a year ago.)

Redfin: In a June 24th press release, Redfin, based on its analysis of MLS filings, reported that one in six homeowners who bought after the pandemic are at risk of losing money in today’s market. (The risk is significantly greater for condo owners than for house owners.)

What’s worse, if home prices drop, those numbers climb dramatically. Location is also a key factor. For example, a condo purchased in the San Francisco Bay area after the pandemic, has a 35.6% chance of selling at a loss in today’s market.

In the Austin area, 13.2% of single-family home sellers are likely to be selling at a loss. Those least likely to sell at a loss today are: a) people who bought prior to the pandemic and b) people who live in the Boston/Providence areas.

Another OCC report (6/23/25) measures the quality of first-lien mortgages at seven of the nation’s largest banks (i.e. JPMorgan Chase, BofA, Wells Fargo, etc.). The report indicates a clear increase in stress in the mortgage market.

Loan modifications increased 7.6% in the first quarter 2025 as compared to the 4th quarter of 2024. Foreclosure volumes were 60.5% higher. While the modifications are intended to avoid the foreclosure process, a quarter of modifications from just 180 days earlier were still struggling to make their payments in the first quarter ’25.

This is particularly disconcerting after a Wall Street Journal (WSJ) article (June 14, 2025) reported that there were almost half a million more sellers than buyers in April. That (according to Redfin) is the biggest gap since 2013, and it’s growing. That means home prices will likely drop. In fact, we are already seeing that here in Florida.

Parts of the Northeast and Midwest are still experiencing a sellers’ market, but for most of the country, the tide is turning. Another WSJ article (June 24, ’25) confirmed that: While the number of underwater homeowners nationwide is still fairly small, there are pockets, like Cape Coral, Florida (ground zero for the 2008 housing crisis) where more buyers bought at the peak of the market and are now underwater.

Cape Coral, once again, is the leader in these underwater mortgages. In 2008, many homeowners in Cape Coral simply walked away. The house keys were often the only thing left behind. The bank/mortgage holder was left to deal with the sale... and the loss.

We are not saying that history is going to repeat itself. Only time will tell us that. What we are saying is that our radar is on alert.

Earlier this year, we reported that: Problem loans were climbing (JRN 42:04); and home sales had dropped to their lowest level in nearly 30 years (JRN 42:05). But, banks, as a whole, are in a much better position today:

- At the end of 2007, banks’ aggregate leverage capital ratio was under 8%. It is well over 9% now, and has been for several years;

- In 2007, subprime lending was rampant. Thankfully, that is no longer the case as lending standards tightened considerably after the 2008 housing collapse; and

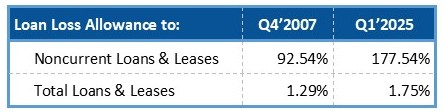

- Loan loss allowances (money set aside in the event of loan losses) are much higher today than they were 18 years ago. See chart below.

In fact, on page 5 of this week's Jumbo Rate News, we have 50 5-Star banks that each have at least $155 million outstanding in pristine single-family home loans—no delinquencies (90 days+) or home repossessions were reported at March 31, 2025. Notably, they are also all profitable.

Many of them do, however, have single family residential property loans that are 30-89 days past due as of March 31st. For example:

5-Star Cullman Savings Bank, Cullman, AL (30167) reported $3.989 million in past due residential real estate loans ($3.938 million in first liens and $51,000 in junior liens);

5-Star American Riviera Bank, Santa Barbara, CA (58281) has $3.918 million, all of which is past due first liens;

At 5-Star Bank of San Francisco, CA (58069) just $278,000 is 30-89 days past due;

5-Star C3bank, N.A., Encinitas, CA (25249), formerly First NB of Southern California, has no short or long term delinquencies of any kind on its books as of March 31st.

Perhaps another housing bubble is looming; The signs are there. But, if it does, it should not be nearly as bad as the 2008 bubble; our banks are simply much better prepared.