After several years of losing employees by way of a slow taper, the banking industry hired robustly during and after the COVID shutdown.

By 2023, the industry was ready to shed some of those new hires, and it did so. The industry lost more than 45,000 employees in that year alone, but it wasn't done.

This week we look at the biggest bank job shedders of 2024. With a total loss of 27,000 jobs, it may surprise you to learn that one bank was responsible for more than half of them.

More than 27,000 Bankers Lost Their Jobs in 2024

The banking industry “had been” losing employees at an annual rate of less than half a percent for years. This was perfectly reasonable as the industry continued to contract.

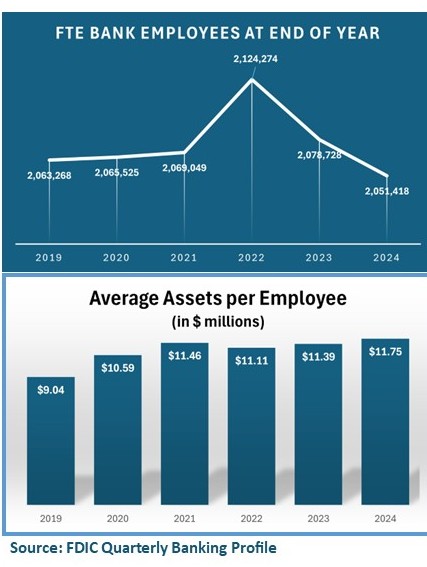

Then COVID hit. In 2020, hiring was up slightly (0.1%) and another 0.2% in 2021. This made sense as the Paycheck Protection Program was in full swing. However, banks became overexuberant in their hiring in 2022, increasing staff by 2.7%. A correction was clearly needed. We saw that correction in 2023 with a loss of 45,500 jobs (2.2% of the total).

The number of full-time equivalent (FTE) U.S. bank employees dropped another 1.3% in 2024. Was this simply a continuation of the correction, or something else?

Over 75% of the 2023 job losses came from just nine banks. 4-Star Wells Fargo Bank, Sioux Falls, SD (B-3511) lost over 10,000 by itself in 2023. It lost another 7,000 in 2024.

That was nearly twice as much as the #2, which was 4-Star CitiBank, Sioux Falls, SD (B-7213). CitiBank added 13,000 jobs in 2022, then lost 5,000 in 2023 and another 8,500 in 2024. That’s a total of 13,500, and we don’t think its done.

But a bank half that size, lost 13,000 FTE jobs all by itself in 2024. That bank is 4-Star Truist Bank, Charlotte, NC (B-9846). You will find Truist Bank listed on page 5 among the 50 banks that began calendar 2024 with at least 75 employees but lost 12% or more of their workforce during the year.

You may recall, Truist Bank was the result of the acquisition of the beloved regional, SunTrust Bank by Branch Banking & Trust, or BB&T in December of 2019. (Not the best timing in hindsight.)

At that time, SunTrust was a $221 billion asset, 5-Star bank. BB&T, also rated 5-Stars weighed in at just slightly more ($230 billion). Assets and employees both peaked in 2022, along with the rest of the industry. Since then, the now $523 billion asset bank has been cutting back on both.

In the two years ended 12/31/2024, Truist Bank has divested over $23 billion in assets and lost nearly 16,000 employees. How much of that can be blamed on the pandemic and how much was merger-related is anyone’s guess. There were certainly areas of redundancy in the combined bank.

One thing we can say in favor of Truist is that efficiency at the bank is head and shoulders above the industry average, at least as measured by assets per employee. Average assets per FTE for the entire industry calculates to $11.75 million. Assets per FTE at Truist Bank is an impressive $14.8 million, and climbing. (For comparison purposes, assets per FTE at CitiBank and Wells Fargo are 9.7% and 8.9%, respectively.)

Not all banks are cutting staff, of course. But, most that are increasing FTE are doing so via acquisition. That means, in all likelihood, they will be reducing FTE again as they assimilate.

That is not the case for 4-Star Texana Bank, N.A., Linden, TX (B-3302). Established in 1914 as First National Bank of Linden, the only changes this community bank has made over the years have been organic. In its 111 year history, Texana Bank has opened new branches, (it now has four in Texas and two across the state line in Arkansas). The name was changed in 2009 to reflect this broader, cross-state community. And, like many small town communities that cross state borders, the state is much less consequential than the community.

Texana Bank is a true community bank. Part of being a community bank is employing residents of the community. Texana Bank added 135 new employees to its ranks in 2024 alone. That’s a 115% gain. Texana Bank is not just bucking the trend of shedding jobs, it is going hiring crazy.

Beal Bank Changes Names

Speaking of Texas, 4-Star Beal Bank, Plano Texas (B-32574) has changed its name to XD Bank, same address. It seems as though changing the signage and website have not been completed as of yet, but you will soon see the Beal Bank moniker fade away. The only Beal Bank then will be 3½-Star Beal Bank USA, Las Vegas, NV (B-57833). In the meantime, do yourself a favor and search by certificate number or both names.