It has been almost five and a half years since the first round of Paycheck Protection Plan (PPP) loans began rolling out.

In this week's post, we are looking at which banks and credit unions still have PPP loans on their books as the program winds down.

We would also like to commend federally-insured institutions for taking part in this effort to keep the economy afloat. An evaluation report from the U.S. Small Business Administration's Office of Inspector General (11/13/2024) states that PPP fraud was significantly less at these banks and credit unions than at non-bank (non-federally insured) institutions.

Paycheck Protection Program Winding Down

It was April 3, 2020, almost five and a half years ago, that The program, implemented hastily, was intended to prevent the economy from coming to a complete halt during the COVID pandemic lockdown.

In total, 5,136 federally-insured banks and credit unions issued over 8.5 million PPP loans worth more than $730 billion. Another 186 other (non-federally-insured) lenders also issued nearly three million loans worth another $61 billion.

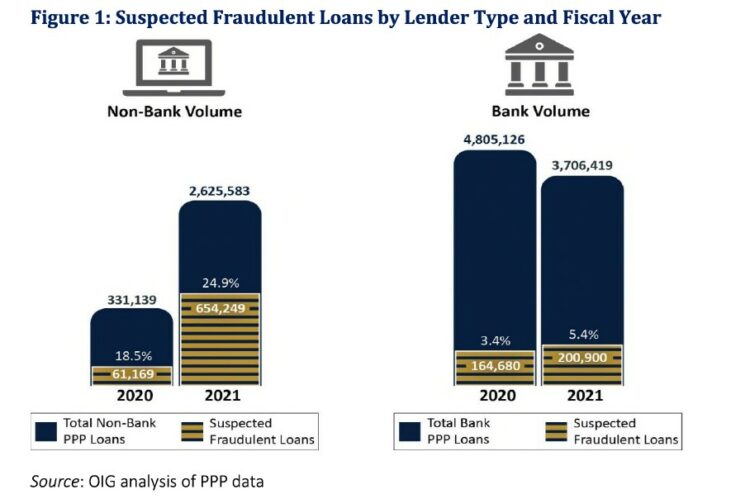

Of the non-federally insured lender loans, 715,000, with a value of $14.2 billion, were suspected to be fraudulent. That’s 24.6% of all PPP loans made by these non-bank lenders, compared to 4.3% made by banks and credit unions. (Figure 1 was extracted from an SBA Office of Inspector General PPP Evaluation Report dated Nov. 13, 2024.)

With a suspected fraud rate more than five times that of federally-insured institutions, this chart alone, presents a compelling argument against non-bank lenders getting involved in a federal program such as this. That is not our focus today, however.

Regardless of where the loans were originated, PPP loans were (and some still are) largely forgivable, as long as all requirements were/are met. (Visit the U.S. Small Business Administration (SBA) for details.) Whether forgiven by the government or paid by the borrower, the vast majority of these loans are now off the books of the lenders.

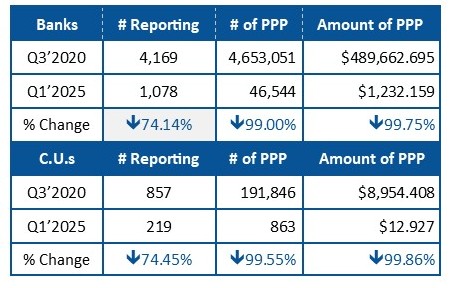

Not all, however. Based on March 31, 2025 data, there were still 1,078 U.S. banks and 235 credit unions carrying Paycheck Protection Program (PPP) loans on their books. These 47,428 loans are worth a total of $1.245 billion, averaging just over $26,000 each.

The 52 banks with more than $2.5 million still outstanding can be found on page 5. Only one credit union has that much: 5-Star Mountain America FCU, Sandy, UT (24692), which started out with over 7,000 PPP loans (more than any other CU), still has the highest dollar amount. A peek at June data shows it’s now down to 10 loans worth just under $2.9 million.

5-Star Navy Federal Credit Union, Vienna, VA (5536), the nation’s largest credit union, still reports 98 PPP loans worth $103,741. That’s an average of just about $1,000 per PPP loan still outstanding at June 30th.

Credit unions as a whole, have done great job whittling these down. Although, there is one we are concerned about.

Zero-Star 1st Choice Credit Union, Atlanta, GA (67505) is not just rated Zero-Stars, it is also “Critically Undercapitalized” by regulatory standards. It has a negative regulatory capital ratio and a growing existence of problem loans. The $315,000 remaining outstanding in PPP is the least of its worries.

As for banks, 4-Star Cross River Bank, Fort Lee, NJ (58410) has consistently been a leading PPP lender. In fact, we highlighted as such in JRN 39:47: “Cross River Bank has been a leading PPP lender since the beginning. At its peak, June 30, 2021, Cross River Bank had 554,708 PPP loans totaling $11,234.4 million. It was surpassed only by two Big Banks”

Those two big banks: 4-Star JPMorgan Chase Bank, N.A., Columbus, OH (628) & 4-Star Bank of America, N.A., Charlotte, NC (3510) are still on page 5, but with much less still outstanding than Cross River Bank.

In fact, at the rapid rate these balances are being paid off now, we expect these remaining numbers to dwindle quickly.

To that point, we pulled Cross River Bank’s second quarter 2025 call report. In the second quarter alone, the number of PPP loans outstanding at Cross River Bank dropped from 15,405 to just 864; the balance owed dropped from $495 million to under $18 million.

Over 90% of banks that still reported PPP at March 31, 2025 reported less than $1 million outstanding. Compare that to the peak of the program (Q3’2020) when less than 1% of reporting banks had under $1 million. It won’t be long before they are all off the books, and PPP becomes just a memory.