U.S. consumers are making great strides in reigning in their collective debt. This was evidenced by a 5.1% decrease in consumer loans during the 12 month period that ended June 30, 2025.

The credit card portion of those loans is not faring so well, as credit card balances increased 3.3% during that same time. Six Big Banks hold 57% of all consumer loan balances and they are all performing quite well. Many other banks, however, are struggling with these loans.

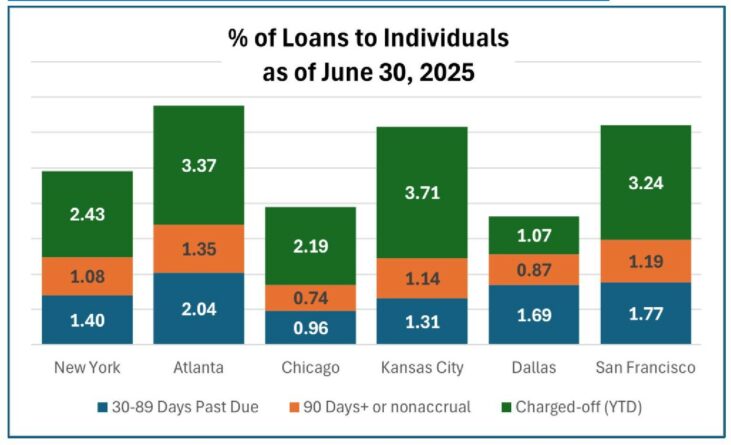

Banks in the Atlanta Region, for example, reported that 6.76% of consumer loans were in arrears to some degree at June 30, 2025. Continue reading to see how banks in your region are faring.

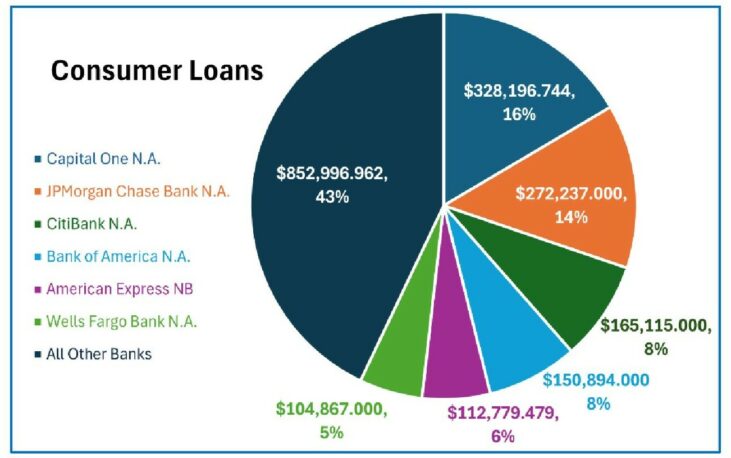

Six Banks Hold 57% of Industry Loans to Consumers

With over $1.1 trillion in consumer loans combined, six big U.S. banks now hold 57% of the banking industry’s total (nearly $2 trillion) in consumer loans. Nonperforming consumer loans at these six banks range from 0.69% at American Express NB, which is quite good, to 1.75% at Capital One, which is still grappling with the Discover Bank acquisition. The nationwide nonperforming consumer loan average is 2.11%. That, combined with the fact that these six banks are all rated 4-Stars or better by Bauer, played a part in our decision to focus this week on other consumer lenders.

We found 51 banks that each have more than $1 million outstanding in consumer loans as of June 30, 2025, that are also rated less than 4-Star by Bauer. In addition, each reported at least 1.65% of total consumer loans as nonperforming (90 days or more delinquent or in nonaccrual status) at the close of the second quarter.

FUN FACT

Between June 30, 2024 and June 20, 2025 consumer loans at U.S. banks decreased by 5.1%, the credit card loan portion, however, increased by 3.3%.

Some of these banks you have seen before, like 3½-Star Comenity Capital Bank, Draper, UT (57570) and its affiliate 3½-Star Comenity Bank, Wilmington, DE (27499), both part of Bread Financial Holdings (JRN 41:05, 42:06). Substantially all loans at these two banks are consumer loans.

At 2.98%, Comenity Bank’s nonperforming loan to tangible assets ratio dropped below the 3% mark for the first time in two years on June 30th . This nonperforming ratio has not made quite the same improvement at Comenity Capital Bank, but it is working on it (3.09% currently). These sister banks have an important commonality, however; each has a substantial loan loss reserve set aside… just in case.

You may also remember 2-Star Crescent Bank, New Orleans, LA (33492) (JRN 42:06). Crescent Bank provides auto loans to consumers across 32 states. In fact, its loan portfolio is comprised “almost” entirely of auto loans (more than 91%). Of its $829.241 million in outstanding auto loans: $10.792 million are in nonaccrual status (1.3%); $14.326 million are 90 days or more past due (1.7%); and $170.543 million are 30-89 days past due (20.6%). Translated, almost a quarter of its largest loan segment is in some form of past due status.

This situation is not new. In fact, the FDIC issued an enforcement action against the bank in January for this and other ongoing shortcomings at Crescent Bank. Just last week (October 10th), the main office of Crescent Bank, 10 Poydras Street in New Orleans was permanently closed. We can only assume this was to help the bank comply with new, more stringent capital ratio requirements. Customers will now have to travel to Metairie (or beyond) for their banking needs.

Another bank that appears on this list is 3½-Star Genesis Bank, Benoit, MS (15817), a small, $74.5 million asset bank that provides another example of too much concentration in one type of loan/borrower. Consumer loans account for over 94% of total loans at Genesis Bank. What’s more, consumer loans increased more than 25% over the 12 months ended June 30, 2025. That may only be $10 million, but it’s a lot for a bank this size.

Genesis Bank has a lot in its favor, though: a very strong leverage capital ratio (17.91%); it has posted a profit for each quarter in the past three years; and, even removing all delinquent loans from the equation, its Bauer’s adjusted capital ratio is still 16.65%. That is all great news. However, reserves at Genesis Bank are not sufficient to cover even 50% of delinquent loans. That is where this bank needs to improve.

Another fun fact, Genesis Bank and Crescent Bank both hale from the Atlanta Region. As the chart (below) clearly shows, this region has the highest ratio of combined past due loans to individuals based on June 30, 2025 financial data.