According to the 40th annual “informal” survey conducted by the American Farm Bureau Federation (AFBF), the cost of Thanksgiving Dinner is down about 5% this year from last, yet is still almost 18% higher than it was back in 2020.

Prices remain lowest in the South, while people in the West can expect to pay about 12% more than the national average.

At Bauer, we like to express our thanks, particularly at this time of year, to the farmers and ranchers that make this feast possible, as well as to the bankers who help keep them afloat.

Thanksgiving Dinner Cost Down Slightly This Year

Despite what it might feel like at the grocery store, the price of a traditional Thanksgiving Dinner has decreased for the third consecutive year. According to the annual “informal” survey conducted by the American Farm Bureau Federation (AFBF). The cost for a family of 10 is down about 5% this year from last.

That same “Classic Basket” is down nearly 14% from its record high in 2022, yet it is still almost 18% higher than it was in 2020. The AFBF appears to be having trouble with the expanded portion of the survey, which added ham, russet potatoes and green beans in 2018.

The ham, in particular, is difficult to get an apples-to-apples (or ham-to- ham) comparison on. The survey started with bone-in. When that was hard to find, it went to boneless. Now, semi-boneless and spiraled hams seem to dominate the shelves. So, while they did not itemize the expanded costs this year, the survey suggests the expansion is less than half a percent off from last year.

The star of traditional Thanksgiving Dinners, the turkey, will cost 16% less this year than in 2024. While this price continues to fall, so does its demand. Americans are consuming an average of just 13 pounds of turkey per year, nearly 3 pounds less than six years ago.

Prices of vegetables and sweet potatoes rose the most, up 61% and 37%, respectively, since last year. Dinner rolls and stuffing/dressing “the breads”, moved the most in the opposite direction—down 14.6% and 9%, respectively.

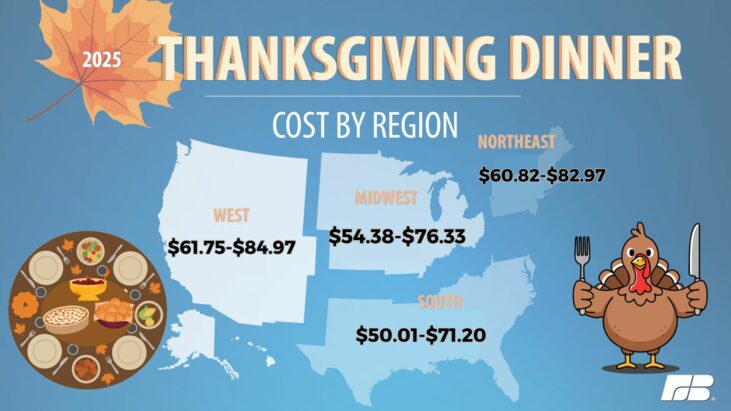

Of course, cost will vary depending on where, in this vast Nation, you are located. The chart below shows the average cost, according to the AFBF survey, by region. The smaller dollar amount refers to the “Classic Basket” while the higher number includes the expanded items.

Prices remain lowest in the South, while people in the West can expect to pay about 12% more than the national average. Results will vary.

We like to express our thanks at this time of year to the farmers and ranchers that make this feast possible, as well as to the bankers who help keep them afloat.

To that end, page 5 contains the 50 banks that Specialize in Agriculture Loans and reported the most money outstanding in Farm Loans (either Agriculture or farmland loans) at mid-year 2025. As you can imagine, almost all (48 of 50) are community banks. We are also pleased to report that all are recommended by Bauer (i.e. rated either 5-Stars or 4-Stars).

The bank with the largest dollar amount outstanding is one of the two non-community banks, 4-Star John Deere Financial, FSB, Middleton, WI (35237). John Deere has almost $4 billion outstanding in Ag loans, over three-quarters of its entire portfolio. Much of this is farm equipment financing. John Deere, the company, has been helping build America since 1837; the bank has only been around since 2000.

Similarly, 5-Star United Bank of Iowa, Ida Grove, IA (958) has 76% of its loans dedicated to farmers, but this one is a community bank. United Bank of Iowa is in its 94th year and is the #1 Ag Bank in the Hawkeye State. Its dedicated farm management team is ready to serve.

Established in 1932 with reported assets of $271,695 (that’s thousand) and a single office, the original Ida County State Bank has seen a lot of changes over the years, including more than a dozen acquisitions and a name change. Today, United Bank of Iowa’s assets are approaching $2.5 billion. It operates through 37 branch offices throughout 16 of Iowa’s 99 counties.

Roughly 30% of 5-Star Dakotah Bank, Aberdeen, SD’s (17437) loans are made to farmers or ranchers. That is a much lower percent than the previous two, but still a lot of money. Agricultural banks have agriculture production loans plus loans secured by farmland exceeding 25% of total loans. It qualifies easily.

With total assets approaching $4.8 billion, Dakotah Bank is the second largest community bank headquartered in the Mount Rushmore State and the largest community bank with an Agriculture Specialization in the tri-state area (MN, ND and SD).

Bottom line, each of the banks listed on page 5 is a major contributor to the betterment of our nation’s farmers and ranchers, and we thank them.