Today we look at banks growing their assets without acquiring another institution. (It is possible.)

We see newer banks growing, as they should for at least the first three years, but often a de novo period will last much longer.

We also see some older banks reinventing themselves, admittedly, at times it is to dig themselves out of the weeds.

In other news, the U.S. Mint in Philadelphia ceremoniously struck the final circulating one-cent coin on Wednesday, Nov. 12th, marking the end of an era that began in 1792

These Banks are Growing Without Buying Rivals

Last week’s focus was on banks that grew their assets by acquiring other banks in the first half of 2025. This week we look at those growing their assets more organically. Those with more than 20% of “organic” growth during the first half of 2025 are listed on page 5 in order of highest percent of growth to lowest.

As one might imagine, a good number of these banks are fairly new. Robust growth is expected, particularly in the first several years, of the de novo period. 5-Star Currency Bank, Oak Grove, LA (35019) was established in 1999 as West Carroll Community Bank. It is far from its infancy, but it is on the newer side, especially considering the dearth of de novo banks we have had in the past several years.

In 2013, West Carroll Community Bank expanded outside its home state of Louisiana with the purchase of Eudora Bank, Eudora, AR, and was renamed Commerce Community Bank. It wasn't until 2021 that the name changed to Currency Bank. Asset growth has been fairly steady since that rebranding, but has been particularly robust in 2025. Assets at Currency Bank grew more than 30% during the first half of the year.

That may not seem like much compared to the first bank listed, 2-Star Sidney FS&LA, Sidney, NE (29379), which nearly tripled its assets, but Sidney FS&LA is one of the banks in the older bank category. It is trying to reinvent itself to get out of the weeds. In March 2021, we reported that the OCC had told the then Zero-Star Sidney FS&LA that it needed to obtain a leverage CR of 9% and total risk-based CR of 12% (a far cry from the 4.2% and 8.4% it reported the previous year-end (JRN 39:10)).

That edict eluded the small (less than $20 million in total assets) community bank for four years. It wasn’t until December 2024 that an Indiana-based investor came to the rescue. Jeffrey L. Kittle agreed to acquire and recapitalize the bank.

He did so with enthusiastic support from the bank’s board of directors and a quick rubber stamp from regulators. The transaction was completed in the second quarter.

Sidney’s assets grew significantly, and its net worth grew even more. The result was that between March 31st and June 30th, its leverage capital ratio jumped from 2.12% all the way to 22.86%! Its risk-based capital ratio was equally impressive, going from 5.16% to 52.08%.

The dust will inevitably settle as Sidney FS&LA continues to serve the picturesque city of Sidney. This bank was established in 1899, just about 30 years after the city was founded by the Union Pacific Railroad.

Another community bank with a troubled past, Zero-Star Old Glory Bank, Elmore City, OK (18924) has taken a similar approach but with a different ultimate goal. Again, we have to go back a couple of years.

In June 2023, we wrote: “Established in 1903 as First State Bank, Elmore, OK, the $22 million asset community bank has rebranded to Old Glory Bank, OK. Old Glory Bank has just one location in Elmore right now, but is very busy opening accounts online via its website and mobile app.

With over 40% of its loans already invested in residential real estate, Old Glory Bank is expanding its reach so more Americans can realize their dream of home ownership. It will soon begin offering home loans on its website as well as in person. Due to a sizeable capital injection that coincided with the name change, Old Glory has money to lend. Let’s just hope its lenders keep a tight grip on lending standards.” (JRN 40:25)

The founders of this newly capitalized bank included some big names including: former Secretary of the US Department of Housing and Urban Development Dr. Ben Carson; country music superstar John Rich, New York Times best-selling author & filmmaker, Larry Elder; and former Oklahoma Governor and Congresswomen, Mary Fallin-Christensen.

These self-proclaimed Patriots enjoy two commonalities: a great love of this country and a unified vision for the future of banking.

According to the bank’s website, that future looks like a one-stop, FDIC-insured shop for both traditional banking and crypto banking needs. To date, it remains a vision. While the bank appears to have high expectations for 2026, all we can report on is what we know.

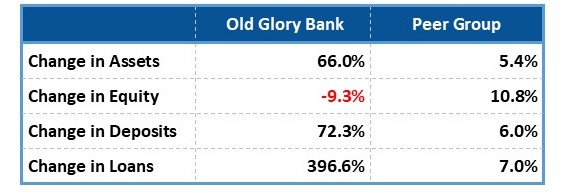

As you can see on page 5, its assets have increased by 26.4% this year, but let’s look at year-over-year changes compared to its peers:

It is growing, in every area except equity capital, which may be why it is looking for more investors. And, if that’s not enough:

It has not posted a profit since the 3rd quarter of ’22; it has been operating under a supervisory enforcement action since May ’24 that both restricts dividends and bonuses as well as requires higher capital. Specifically, it requires a leverage CR of 14% (that ratio was just 4.6% at 6/30/25). Sadly, this bank has also appeared on Bauer’s Troubled and Problematic Bank Report for the past six quarters. Old Glory will need more capital and a sneak peek at 9/30 data does not show any.

RIP Penny: 1792-2025

It used to be said that a penny saved is a penny earned. The concept remains—saving requires sacrifice, so the reward for saving is, in fact, “earned”. However, the U.S. Mint in Philadelphia ceremoniously struck the final circulating one-cent coin on Wednesday, Nov. 12th. Why Now?

Cost: In fiscal 2024, the Mint produced approximately 3.2 billion pennies at 3.69 cents each costing roughly $56 million. Pennies in circulation may continue to be used and limited collector versions will continue to be produced.

Timing: Consumer behavior has evolved to the point that the Secretary of the Treasury has determined the coin is no longer needed to meet our needs. It is believed (hoped) that the pennies already in circulation are sufficient to meet the needs of commerce… but reports to the contrary abound.