We Analyze Banks and Credit Unions Very Carefully

...Because Peace of Mind Matters

Trusted Since 1983

“We have a responsibility to both bankers and their customers and we take that responsibility very seriously.”

What customers say about us

Great Service

Vice President of a California BankI have always appreciated the quick response and service we have received throughout the years.

Instill Confidence

President of a Connecticut BankI cannot compliment Bauer enough. People, especially CD investors, count on your ratings. They give investors more confidence...

Regulators Love Bauer

Sr. Vice President of a Mississippi BankYou guys do a super job, I've had nothing but praise from the regulators and our Board.

All New Bank Star-Ratings Now Available

The U.S. banking industry closed 2025 with a strong full‑year performance-higher assets, earnings, margins, and deposits-yet the fourth quarter data revealed soft spots, including weaker income, rising problem‑loan categories, and a growing reliance on uninsured deposits. Community banks outperformed the…

CD Specials and Strategy Drive Deposit Growth

Acquisitions can produce explosive deposit growth, but organic growth requires targeted strategies like promotional CDs and local outreach. Many high‑growth banks rely on limited‑time, locally targeted CD specials to avoid rate‑shopping bots and to control inflows. While it is difficult…

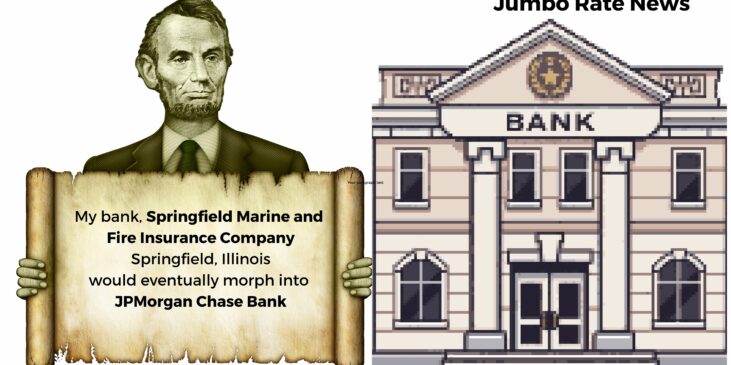

President Lincoln Didn’t Bank Here

In observance of Presidents’ Day, we take a trip back to the civil war era. In 1860, there were an estimated 8,000 state banks, each circulating its own currency. National Banks and our Nation’s dual banking system didn’t come into…