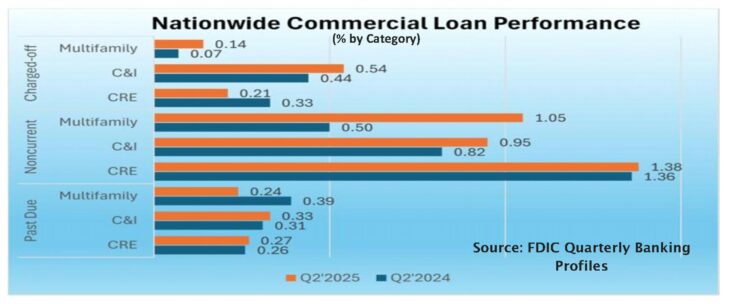

This week we turn our attention to commercial loans (a combination of commercial real estate (CRE), commercial & industrial loans (C&I) and multifamily (5 or more dwellings) residential real estate). As an industry, U.S. banks reported underperforming: CRE of 1.65%; C&I of 1.28%; and multifamily of 1.29%.

Regionally, those percentages vary greatly, particularly the multifamily residential loams. The New York region was way off the mark in this category with 2.36% underperforming.

We are pleased, however, to see community banks gaining more of the market share of commercial loans.

Problems in Commercial Loan Portfolios Persist

In the past few weeks we have discussed residential real estate loans (JRN 42:39), which have a total under-performing rate (30 days or more past due plus nonaccrual loans) of 1.86% at our nation’s banks, credit cards, with a underperforming rate of 2.98% (JRN 42:40), and other consumer loans, which have a noncurrent rate of 2.27% (all as of June 30, 2025 data).

This week our attention goes to commercial loans (a combination of commercial real estate (CRE), commercial & industrial loans (C&I) and multifamily (5 or more dwellings) residential real estate). As an industry, U.S. banks reported underperforming: CRE of 1.65%; C&I of 1.28%; and multifamily of 1.29%. (See chart below.)

CRE witnessed a 29 basis point (bp) increase (to 1.65%) in these underperformers nationwide, with the Kansas City region reporting the highest at 2.45% (21 basis points higher than last year). Dallas reported the lowest at 1.08%.

Underperforming C&I loans had a nationwide average of 1.28% with the San Francisco region reporting the highest rate at 1.55% followed closely by Chicago at 1.51%.

Nationwide, multifamily underperformers represent 1.29% of the total. The New York region is way off the mark in the category with 2.36% underperforming. The next closest is Kansas City at 1.35%. (All other regions are under 1%.)

3½-Star BayFirst National Bank, St. Petersburg, FL (34997) serves as an example of how commercial loans can turn into a negative. BayFirst reported a net loss of $1.2 million for the first six months of 2025, at which time it also announced it was working on “derisking” its unguaranteed SBA (Small Business Administration) loans. In its case, charge-offs and fair value write-downs on these loans were blamed for those losses. That is certainly a risk in a changing rate environment.

On page 5, we have a list of all banks rated less than 4-Stars where commercial loans (CRE, C&I and multifamily) account for at least 45% of total loans that also reported delinquent commercial loans of 3.25% or higher. Not only is this a much higher percent than BayFirst’s 2.14%, it is also much higher than the 2.9% cutoff we used six months ago, based on year-end 2024 data (JRN 42:19). This is another indication that commercial loan performance has continued to deteriorate.

The biggest deterioration from June 2024 to June 2025 came in the form of underperforming multifamily (5 or more family real estate). The decline was greatest in the New York Region (which went from 0.94% noncurrent last June (2024) to 1.94% noncurrent this June). The Kansas City region jumped all the way from 0.29% to 1.23% over the year. These increases can be blamed largely on Mother Nature, but that doesn’t help matters.

The Kansas City Region also reports the highest underperforming CRE rate at 2.23% (down 1 basis point from last year). Yet, of the 51 banks listed on page 5, only five are headquartered in the Kansas City Region. The Atlanta Region, where BayFirst is from, also only has five listed. The New York Region is most represented with 14 listed on page 5, followed by the Dallas Region with 13.

One new addition to the list this time is 1-Star Tioga-Franklin Savings Bank, Philadelphia, PA, (33802), a small community bank in the New York Region, and the oldest chartered bank in Philadelphia. In the past couple of years, Tioga-Franklin has been moving away from residential home loans in favor of commercial loans. Tioga-Franklins commercial loans increased from less 30% of total loans to now representing 50%. Its delinquent commercial loans have been on the rise as well – from 8.15% to 10.81%, but it was the increase in commercial loans that added this bank to the list. It is not alone.

While Big Banks hold nearly 80% of all commercial loans, they only represent 10% of the banks on page 5.