In the past two years we have witnessed a steady rise in delinquent commercial loans, even as outstanding balances have been fluctuating.

Today we examine how these changes are reflected in the banking industry as a whole, as well as how several individual banks are handling the rise in troubled loans.

On page 5 of this week's Jumbo Rate News, we have listed 50 banks with high delinquency rates in their commercial loan portfolios as of March 31, 2025.

Troubled Commercial Loans are on the Rise

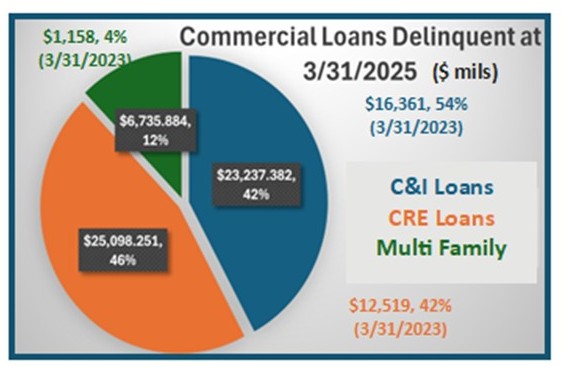

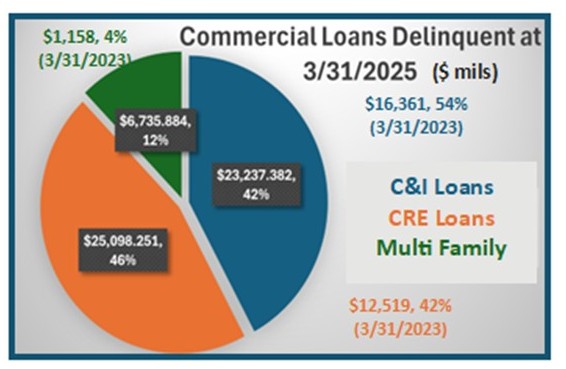

About every 6-months, we report on the status of commercial loans at our nation’s banks. This includes Commercial & Industrial loans (C&), Commercial Real Estate (CRE) and/or Multi Family (5 or more) residential loans. The chart below clearly shows that, even though loan growth has been mixed, delinquent loans (loans that are 90 days or more delinquent or in nonaccrual status) are rising steadily in each of these categories.

During the 2-years ending March 31, 2025:

C&I Loan balances decreased by 6.15%, during the 2 years and now represent 47% (was 49%) of total commercial loans outstanding. The 3.68% increase in outstanding CRE loans and the 7.72% jump in multi family loans muted the loss to the overall category. Total balance outstanding is now 0.67% lower than it was 2 years ago. The pie chart depicts the breakdown, with the 2023 numbers outside of the pie.

While commercial loan growth has been muted, at best, delinquent commercial loans are burgeoning.

CRE loans account for 39% of all commercial loans while delinquent CRE loans now represent 46% of the total. Multi Family residential loans had been faring quite well with just 4% of the delinquent loan pie 2 years ago. Multi family loans account for 14% of all commercial loans. A 482% jump in the problem portion increased its slice of delinquent pie from 4% all the way up to 12%.

In a perfect world, the percentages would be the same on both pie graphs… (or zero).

These are the numbers for the banking industry as a whole, based on call report data. As we all know, however, not all banks are equal.

On page 5 of this week's issue of Jumbo Rate News, we have provided a list of 50 banks, each rated 3½-Stars or below, where: loans constitute at least 50% of total assets; at least 45% of total loans are commercial loans (as we have defined them); and at least 2.5% of those commercial loans are 90 days or more delinquent.

At 21.03%, 2-Star State Exchange Bank, Lamont, OK (13551) has the highest overall commercial delinquency rate on page 5. It also reported the highest Multi Family residential delinquency rate of 92.37%. To be fair, State Exchange Bank only has $3.053 million outstanding in multi family residential loans on its books. That’s just 3.4% of its total loan portfolio, 6.6% of its commercial loans.

State Exchange Bank is a small, community bank that we last reported on in January (JRN 42:04). At that time we were working off September 30, 2024 financial data and State Exchange had a Bauer’s Adjusted Capital ratio (CR) of 1.09%. Today, that ratio has turned negative (-1.71%) to be precise. Over 92% of its problem loans are commercial.

3½-Star Metropolitan Capital Bank & Trust, Chicago, IL (57488) reported the highest delinquent CRE loan ratio at 33.42%. However, CRE only accounts for 8.5% of its commercial loans, C&I accounts for 83.6%. The delinquency rate on all its commercial loans is 5.23%. At 4.82%, the delinquency rate on its entire loan portfolio is still high, but lower.

Of the banks listed on page 5, 2-Star Touchmark National Bank, Alpharetta, GA (58687) had the highest C&I delinquency rate of 56.25%, but it only has $20 million of these loans outstanding. The majority of Touchmark’s loans are CRE. Of its $340 million in CRE loans, only 1.4% ($4.87 million) are 90 days or more in arrears. Its total delinquent loan rate is 4.45%.

Some of the banks had extreme year-over-year jumps in their delinquent loans. 3-Star First Guaranty Bank, Hammond, LA (14028) was one such bank. Last year, (March 31, 2024) First Guaranty Bank had 1.86% of its commercial loans 90 days or more past due. That ratio was up to 7.09% after 12 months.

1-Star Grand Rivers Community Bank, Grand Chain, IL (10816) was even more alarming. It had zero delinquent commercial loans a year ago. By this past March, over 13.5% were 90 days or more past due.

During the 12 months noted, Grand Rivers’ nonperforming assets as a percent of Tier1 Capital went from zero to 74.24%; its Bauer’s Adjusted CR dropped from 8.32% to 2.56% and its Texas Ratio jumped from zero all the way to 56.3%. Grand Rivers has been a fixture on Bauer’s Troubled and Problematic Bank Report since 2016. This $18 million community bank definitely needs a turnaround. It is an important asset for the community as no other bank has offices in either Grand Chain or Karnak, Illinois.

1 comment on “Troubled Commercial Loans are on the Rise”

Comments are closed.