Don’t Let Scammers Steal Your Holiday Cheer: Expert Tips to Stay Safe This Season

As holiday shopping and celebrations ramp up, fraudsters are getting more creative. Here’s how to protect your wallet—and your peace of mind.

Coral Gables, Florida – December 2025: The holiday season should be a time of joy, not financial heartbreak. Unfortunately, scammers know this is when people are most distracted—and they’re using increasingly sophisticated tactics to take advantage.

“Financial scams have been around forever, but today’s schemes are harder to spot than in the past,” said Karen Dorway, President of BauerFinancial, Inc. “From fake bank calls to AI-generated voices, criminals are pulling out all the stops. So, in hopes of helping you keep your wallets safe, we will explain some of the most egregious ploys to date. You’ll notice an overriding theme of ‘sleight of hand’ – things not being what they appear to be. Awareness is your best defense.”

Top Holiday Scams to Watch Out For

Bank Impersonator Scams

Fraudsters can make your bank’s phone number appear on your caller ID—a trick called spoofing. If you get an unexpected call, don’t answer. If a voicemail is left, do NOT use your phone’s callback feature. Instead, dial the number on the back of your card – manually – to confirm.

Text Traps

Texts about package delays, security alerts, even job offers may look legitimate—but they’re often scams. If you don’t recognize the sender, delete and report it. And never respond to ‘wrong number’ texts—they’re bait.

Fake Crisis Scams

AI technology now allows scammers to clone voices, making it sound like a loved one is in trouble. If you get a frantic call asking for money, pause and verify before acting. Similarly, ignore pop-up warnings on your computer urging you to call or click for ‘security fixes.’

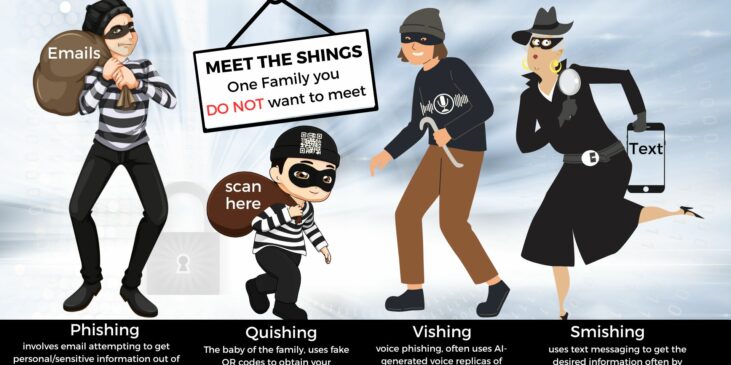

No list of possible schemes is ever complete as they constantly evolve. However, knowing about this family could help keep your family safe:

How can You Know if You are being Targeted?

You can’t. The safest thing to do is to assume the worst.

- Never share personal financial information unless you initiated the contact through a trusted channel.

- Talk to friends and family—especially elderly relatives—about these scams.

- Ask your financial institution about extra security measures.

- Keep your phone secure and never let strangers handle it.

“Scammers thrive on distraction, urgency and fear,” added Dorway. “The best gift you can give yourself this season is peace of mind—by staying alert.”

Enjoy the Holidays—Safely

Once you’ve taken these precautions, relax and enjoy the festivities.

BauerFinancial, the nation’s premier bank and credit union rating firm.

Helping protect your deposits since 1983.

###

Media Contact:

Caroline Jervey

Vice President, BauerFinancial, Inc.

(800) 388.6686

cjervey@bauerfinancial.com

BauerFinancial, Inc. P.O. Box 143520, Coral Gables, FL 33114 bauerfinancial.com