The U.S. banking sector experienced a net reduction of 4,395 full‑time equivalent (FTE) employees in 2025, with 31.5% of banks cutting staff while 49.9% expanded headcount. Regulatory actions drove the downsizing at some institutions, while other banks leveraged restructuring to…

All New Bank Star-Ratings Now Available

The U.S. banking industry closed 2025 with a strong full‑year performance—higher assets, earnings, margins, and deposits—yet the fourth quarter data revealed soft spots, including weaker income, rising problem‑loan categories, and a growing reliance on uninsured deposits. Community banks outperformed the…

CD Specials and Strategy Drive Deposit Growth

Acquisitions can produce explosive deposit growth, but organic growth requires targeted strategies like promotional CDs and local outreach. Many high‑growth banks rely on limited‑time, locally targeted CD specials to avoid rate‑shopping bots and to control inflows. While it is difficult…

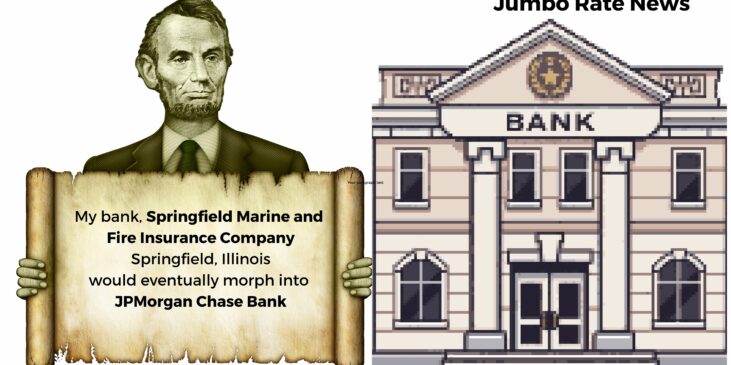

President Lincoln Didn’t Bank Here

In observance of Presidents’ Day, we take a trip back to the civil war era. In 1860, there were an estimated 8,000 state banks, each circulating its own currency. National Banks and our Nation’s dual banking system didn’t come into…

Hawks, Doves and Other Predators

This week we tackle several topics, from the year’s first bank failure to the president’s nominee to replace Jay Powell at the helm of the Federal Reserve. We go on to elaborate on the difference between monetary Doves and monetary…

Controversial Industrial Loan Charter Back in Play

It looks as though we may be getting more new banks this year than we have in long time. Both community bank and industrial loan company (ILC) applications are receiving provisional approvals. Ford and GM are both in the latter…

As Big Banks Consolidate, Community Banks Step In

During 2024 and 2025, the U.S. lost close to 1,500 bank branches (net). As bigger banks merge and shutter offices, community banks are stepping in to fill the void they leave behind. When acquired branches are closed due to close…

Loan Quality not Holding Steady at all Banks

According to the FDIC’s Quarterly Banking Profile, U.S. banks held their past due and nonaccrual loans steady during the third quarter 2025. But, that is as a group. Not all U.S. banks are faring as well with loan performance. Today we…

Where Did That Bank Go?

2026 is shaping up to be an even busier year for bank mergers and acquisitions than 2025. Prior to January 8, 2026, 11 such combinations were already completed. Information on those transactions as well as 23 other pending mergers/acquisitions can…

Mergers & Acquisitions Dominated Banking in 2025

Welcome to 2026. In this issue, the first of Volume 43 (yes, we have been doing this since 1983), we have provided a rundown of some of 2025’s largest and most interesting bank combinations. The consolidation trend is in full…