All bank star-ratings are now based on September 30, 2025 financial data.

The positive: Bauer reports there are fewer banks relegated to its Troubled and Problematic Bank Report as being rated 2-Stars or below.

The negative: Depositors are increasing their uninsured deposits and in some parts of the country, consumers are struggling to stay current.

Third Quarter Bank Results “Mostly” Positive.

We have been very busy here at Bauer evaluating and updating Star-Ratings with third quarter financial data. As a result, all bank star-ratings at bauerfinancial.com, are now based on September 30, 2025 financial data and new credit union ratings will follow shortly.

Bauer had 42 fewer banks to rate this quarter as industry consolidation continues. The number and percentage of those banks relegated to Bauer’s Troubled and Problematic Bank Report (rated 2-Stars or below) are at their lowest levels since the third quarter of last year.

The FDIC‘s Quarterly Banking Profile revealed many things, and most of them were positive as well. These included:

- Total industry assets were up half a percent from the second quarter and 3.7% from a year earlier.

- Total loans at U.S. banks continue to grow-4.7% for the year and 1.2% in the third quarter.

- Provisioning expenses for loan losses were down 30.7% from the previous quarter and 11.7% from September 30, 2024, although these numbers may be slightly skewed due to acquisitions.

- Total domestic deposits at our nation’s banks increased 0.5% during the third quarter ’25, marking the fifth consecutive quarter of deposit growth.

This Industry deposit growth was attributed to two things: 1) interest-bearing deposits are up as people try to grab onto higher yields before rates go down again (which could be as early as Wednesday, December 10th); and 2) estimated uninsured deposits are up notably from both the year and the quarter earlier periods.

Here’s where we get to the not so pretty picture:

Estimated uninsured deposits now top $7.653 trillion! That’s 7% higher than a year ago and 11.7% higher than at the end of the third quarter 2023. Community banks alone reported a 3.2% increase in estimated uninsured deposits in the third quarter. That’s especially noteworthy because, as a rule, banks with less than $1 billion in total assets are not required to report this number.

We will continue with community bank data now as we peer into consumer debt. While the big banks may hold more consumer debt, they do not allow you to easily see the regional variances that community banks offer.

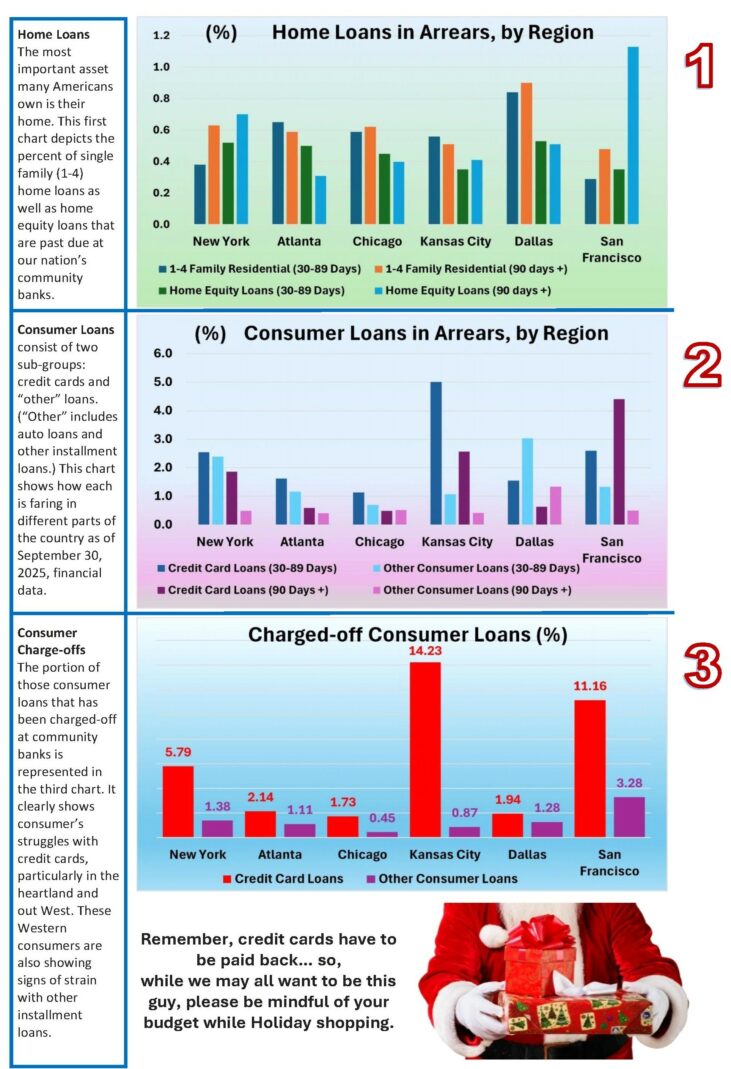

The three charts below are very telling in this sense. For example, we see problem loans in the single-family home loan market creeping dangerously close to the 1% mark in the Dallas Region. The San Francisco Region has kept those well in line but must be mindful of its home equity loan standards. Home equity loans 90 days or more in arrears in the Western Region total 1.13%, almost double the national community bank average of 0.70%. (Although, this average is 1.56% for the entire industry.)

As for other consumer loans (charts 2&3), our eyes go directly to credit card loans in the Kansas City and San Francisco regions. In each instance, charge-offs were well above 10%, yet problems persist. Industrywide, credit cards past due 90 days or more (or in nonaccrual status) represent 1.59%, while those 30-89 days in arrears represent 1.55%. Community banks in the Kansas City Region reported 5% 30-89 days past due while the San Francisco Region’s community banks reported over 4.4% 90 days or more delinquent. Definitely room for improvement.

1 comment on “Third Quarter Bank Results “Mostly” Positive”

Comments are closed.