A couple of times a year, we look at how community banks are growing their deposits. When deposit rates are on the rise, that’s easy enough. But when rates are falling, attracting deposits is a lot trickier. The 50…

Payday Loans Skyrocket at Nation’s C.U.s

Federal Credit Unions are set to gain a new tool in the fight against predatory payroll lenders. The current payday alternative loan (PAL) option has been available to FCUs since 2010, but for the past couple of years, NCUA has…

Bank Branches are Alive and Well

According to the FDIC, 461 banks have opened a total of 744 new branch offices during the first eight and a half months of 2019. While there are exceptions, the vast majority are full-service brick and mortar branches. That’s good…

Banks Brace for Rate Cuts, Credit Card Crunch

The FDIC put a positive spin on second quarter bank results, and with good reason. There was a lot to be pleased about: · Net Income was up 4.1% from second quarter 2018 for the industry while Community Banks reported an…

Mutual Bank Growth Through Conversion

Unlike commercial banks, mutual banks are community banks with no stockholders or direct ownership. They are co-ops, owned by the depositors themselves. Originally created to promote savings and home-ownership, the first mutual was established in Boston in 1816. Historically, Massachusetts…

All Bank Star-Ratings Now as of June Data

All bank star-ratings are now based on June 30, 2019 financial data. (Credit union data will be updated in early September.) And, as a result, Bauer welcomes 104 banks to its top 5-Star category. There are 40 fewer recommended banks…

Why We Love a Good Vanilla

A bank’s Efficiency Ratio measures how much of its operating revenue is spent on overhead, so a lower ratio indicates greater efficiency. According to the FDIC Quarterly Banking Profile (QBP), the average bank efficiency ratio at March 31, 2019 was…

There is no Such Thing as Recession-Proof

We have been reporting a lot lately on different loan categories as we’ve been probing for cracks in the armor. Talks of an impending recession are getting louder and more prevalent, so we will continue that pursuit. This week, however,…

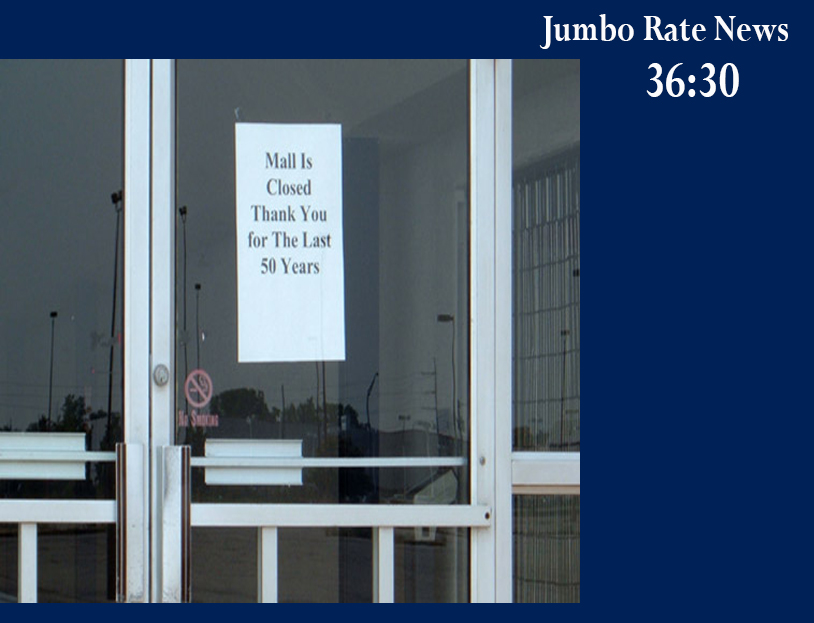

Who’s Afraid of Ghost …Malls ?

Commercial Real Estate (CRE) loans are comprised of multifamily (five or more) residential real estate, office buildings, shopping malls and most other structures that house businesses. Most of which have expanded along with the economy over the past several years.…

Fed Cuts Interest Rates. Now What?

By now you probably know that the Federal Reserve’s Open Market Committee lowered the Fed Funds target a quarter point on Wednesday (July 31st). The range is now between 2% and 2.25% with another quarter point cut widely expected before…