Last week we reported on U.S. banks with robust Commercial & Industrial (C&I) loan growth during calendar 2021. In spite of the winding down of the Paycheck Protection Program (PPP), we found 51 established C&I lenders with at least 35%…

Signs of Life in C&I Lending, Will it Last?

We saw a glimmer of hope in the fourth quarter ’21 data that perhaps a resurgence of commercial and industrial (C&I) loan demand was on its way. Nearly a third of all U.S. banks increased their C&I loan portfolios during…

What a Quarter Point Rate Increase Means to You

You have probably already heard that the Federal Reserve bumped interest rates up a quarter point on Wednesday (3/16/22). You may have also discerned that we are looking at as many as six more boosts this year. Since the Fed’s…

All New C.U. Star-Ratings Now Available

As a whole, the nation’s credit unions performed admirably during calendar 2021. However, NCUA Chairman Todd Harper sounded a similar cautionary tone as we heard last week from his bank (FDIC) counterpart. “The potential for new COVID variants, continuing labor…

All New Bank Star-Ratings Now Available

Pandemic impacts are subsiding but geopolitical strains are rising. It’s a good thing Bauer projects negative trends forward when assigning its star-ratings. The FDIC’s acting chairman, Martin Gruenburg, has even voiced concerns about the future. When remarking Tuesday on how…

NCUA-Insured Ukrainian Credit Unions

With everything happening in and around Ukraine these days, we want to make one thing perfectly clear. Deposits (or shares) at all U.S. chartered, federally-insured banks and credit unions are covered up to $250,000. That, of course, includes the following…

CU Expansion to Serve the Underserved

Community credit unions typically must serve a well-defined community, neighborhood or rural district, but there are exceptions. One such exception is for “underserved” areas. A federal credit union may be allowed to expand outside its defined area if the target…

Insider Loans Top $37 Billion

Last year at this time, we reported on a new rule that would allow businesses owned by bank insiders to apply for Small Business Administration Paycheck Protection Program (PPP) loans (JRN 38:08). There was widespread concern that these loans would…

Some Banks Turning Away from Banking

The Federal Reserve will almost certainly raise short-term interest rates when it meets on March 15/16. It will also publish its summary of economic projections which will shed light on whether its leanings are towards another increase in May. At…

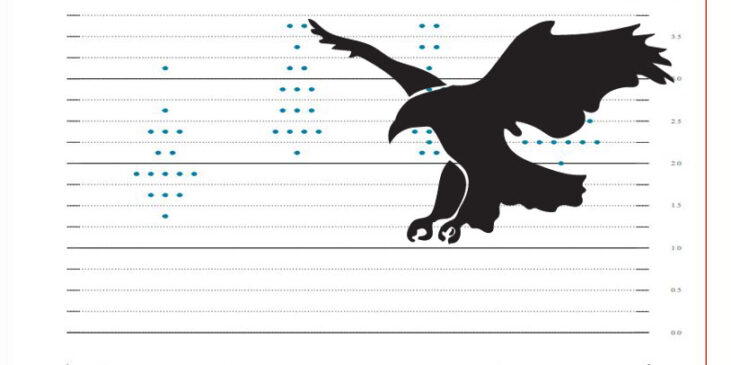

4 Big Banks Account for 37% of 2021 Branch Closures

The U.S. lost over 2,900 bank branches in 2021. While that represents less than 3.5% of the total, it is a new record. The previous record was set in 2020 as COVID began nudging consumers toward mobile banking. Clearly, that…