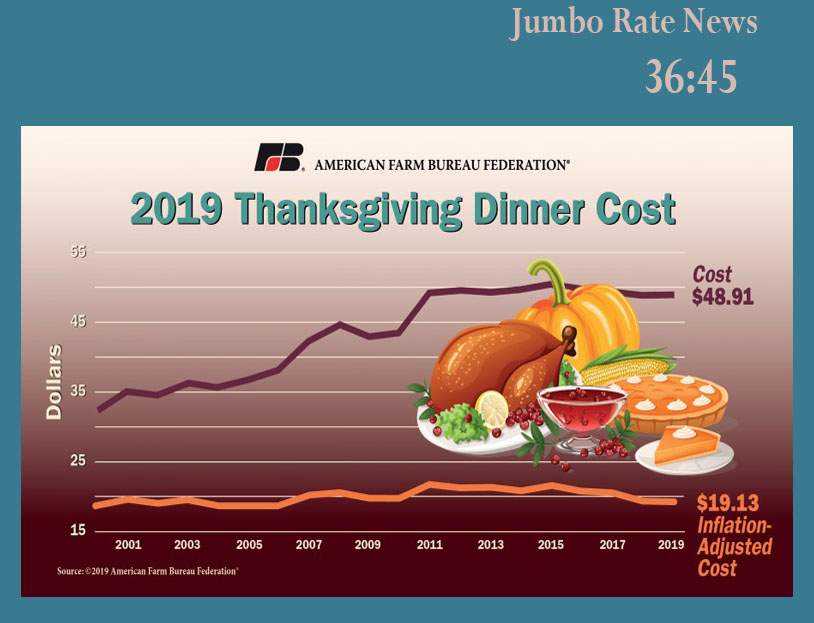

Thanksgiving Dinner Cost Rises 1st Time in 4 Years Every year we look forward to the American Farm Bureau Federation (AFBF) release telling us how much Thanksgiving Dinner should cost. And every year we go shopping and spend considerably more…

De Novo Class of 2019; ILCs Need Not Apply

De Novo Class of 2019; ILCs Need Not Apply This year is shaping up to have the most de novo bank activity in a decade. Ten banks opened their doors during the first three quarters of the year and eight…

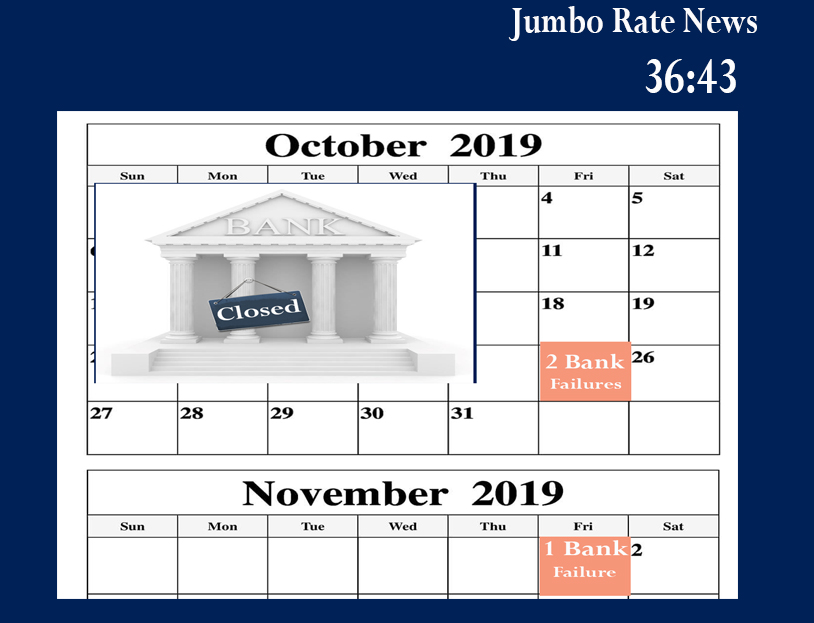

Three Banks Close in a Span of Eight Days

Three Banks Close in a Span of Eight Days The third FDIC-Insured bank in a span of eight days was closed on November 1st. Zero-Star City National Bank of New Jersey was closed by the Office of the Comptroller of…

Two Banks With Much in Common Fail

Two Banks With Much in Common Fail Two banks failed last Friday (October 25th). That’s as many as have failed in the previous two years combined. The immediate question that came to our mind was, what do these two banks…

Credit Unions Up Credit Card Lending

Credit Unions Up Credit Card Lending In the past five years, the nation’s credit unions have increased their credit card lending by 36% (see chart 2). Some of that increase is because more of the industry is offering credit cards…

In Search of Low Cost Funding

In Search of Low Cost Funding We know very well that it’s not what you want to hear, but community banks are in need of low-cost (or no-cost) deposits. Two weeks ago (JRN 36:38) we reported on some creative ways…

Consumer Debt Up, Delinquencies Mixed Picture

U.S. banks charged off $12.8 billion in loans in the second quarter 2019. That’s up $1.1 billion or 9.3% from a year earlier. The majority of that increase was due to uncollectible credit card loans, which were up $669.4 million…

Community Bank Touch Goes a Long Way

A couple of times a year, we look at how community banks are growing their deposits. When deposit rates are on the rise, that’s easy enough. But when rates are falling, attracting deposits is a lot trickier. The 50…

Payday Loans Skyrocket at Nation’s C.U.s

Federal Credit Unions are set to gain a new tool in the fight against predatory payroll lenders. The current payday alternative loan (PAL) option has been available to FCUs since 2010, but for the past couple of years, NCUA has…

Bank Branches are Alive and Well

According to the FDIC, 461 banks have opened a total of 744 new branch offices during the first eight and a half months of 2019. While there are exceptions, the vast majority are full-service brick and mortar branches. That’s good…