In spite of efforts to encourage more de novo bank applications, only seven new banks were chartered last year. In fact, to demonstrate how difficult the environment is… of the 70 banks that have been opened in the past ten…

Government Shutdown Trumps Economic Gains

The Federal Reserve’s Beige Book is a survey of opinions. While qualitative in nature, those surveyed do tend to have their fingers on the pulse of their part of the country. The latest Beige Book was based on information collected…

Consumer Debt: the Good, the Bad and the Scary

We promised last week that we would be paying close attention to consumer debt this year, and what better time to begin. The Federal Reserve conveniently just released its Consumer Credit statistics report for last November. This latest release shows…

2018: The Highlights and the Lowlights

Taking a look back at the year that just ended can sometimes give us a glimpse at what’s to come. We’re not sure that’s a good thing this time around but as they say, “forewarned is forearmed”. The first warnings…

Federal Reserve Bumps Up Rates

Happy New Year! The Federal Reserve’s Open Market Committee voted this week to increase the target Fed Funds rate by 25 basis points. This marks the ninth such increase since beginning the gradual rate rise campaign in December of 2015…

New Credit Union Star-Ratings This Week

New Credit Union Star-Ratings This Week Total assets at the nation’s federally-insured credit unions rose 5.6% ($77 billion) during the 12 months ended September 30, 2018 ending up at $1.44 trillion. The loan portion of those assets was up 9.5%…

Over 200 Banks and Credit Unions Currently on Bauer’s Troubled and Problematic Lists

December 17, 2018: BAUERFINANCIAL, Inc., Coral Gables, FL, the nation’s leading independent bank and credit union rating firm announces it has newly released bank and credit union star-ratings (based on September 30, 2018 financial data) available on its website, bauerfinancial.com.…

Banks Get Bigger, Stronger… at a Price

Banks Get Bigger, Stronger… at a Price As promised, we have more details of third quarter bank data this week. We mentioned last week that total assets of $17.7 trillion were up 2.5% from a year earlier and the $10…

All New BANK Star-Ratings This Week

The banking industry in the U.S. continues making strides; over 90% of the industry is recommended by Bauer (rated 5-Stars or 4-Stars) and there are fewer banks on Bauer’s Troubled and Problematic Bank Report than we have seen since 2007…

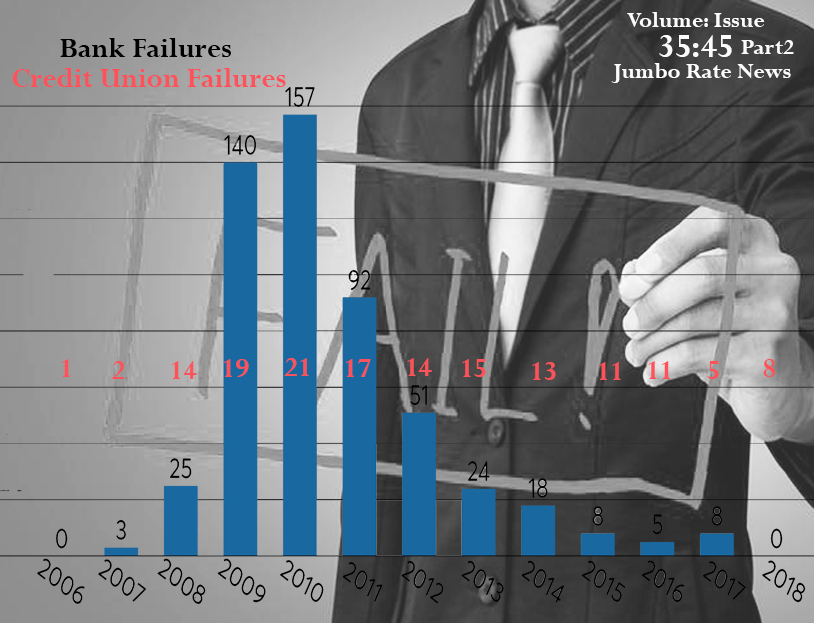

Credit Union Failures Are Far Outpacing Bank Failures

We are quickly approaching the one year anniversary of the last U.S. bank failure (December 15th). The last time we went this long between bank failures was the 31 month stretch from July 2004 through January 2007. We only wish…